Financial Empowerment: Focus on People with Disabilities (MS UCEDD)

June 1, 2017

|

The University Of Southern Mississippi Institute for Disability Studies' (IDS) (IDS) housing staff member, Heather Steele, was invited to Washington, D.C. on May 8 - 9, to collaborate with the Consumer Financial Protection Bureau (CFPB) and Federal Deposit Insurance Corporation (FDIC). The CFPB and FDIC were convening to provide the opportunity for individuals from and serving the disability community to meet in person to learn about and share ideas for using the Your Money, Your Goals toolkit and the supplemental Focus on People with Disabilities Guide, as well as theFDIC's MoneySmart Program to empower people and communities in how they get, plan for and use their money.

IDS' hallmark permanent housing program, Mississippi Home of Your Own (HOYO), has several financial education components integrated within its housing initiatives. In its 20th year of service to Mississippi families, HOYO is an IDS award-winning program. HOYO's focus, similar to the CFPB and FDIC focus, is in creating a support system that identifies potential consumers and analyzes their needs and financial capacity. IDS became a HUD approved Housing Counseling Agency in 2003. The program empowers people with and without disabilities to reach their individual dreams of owning and maintaining their own homes. Since 1997, HOYO has assisted more than 677 families in 65 Mississippi counties in becoming homeowners. All articipating families were required to obtain individual and group financial education.

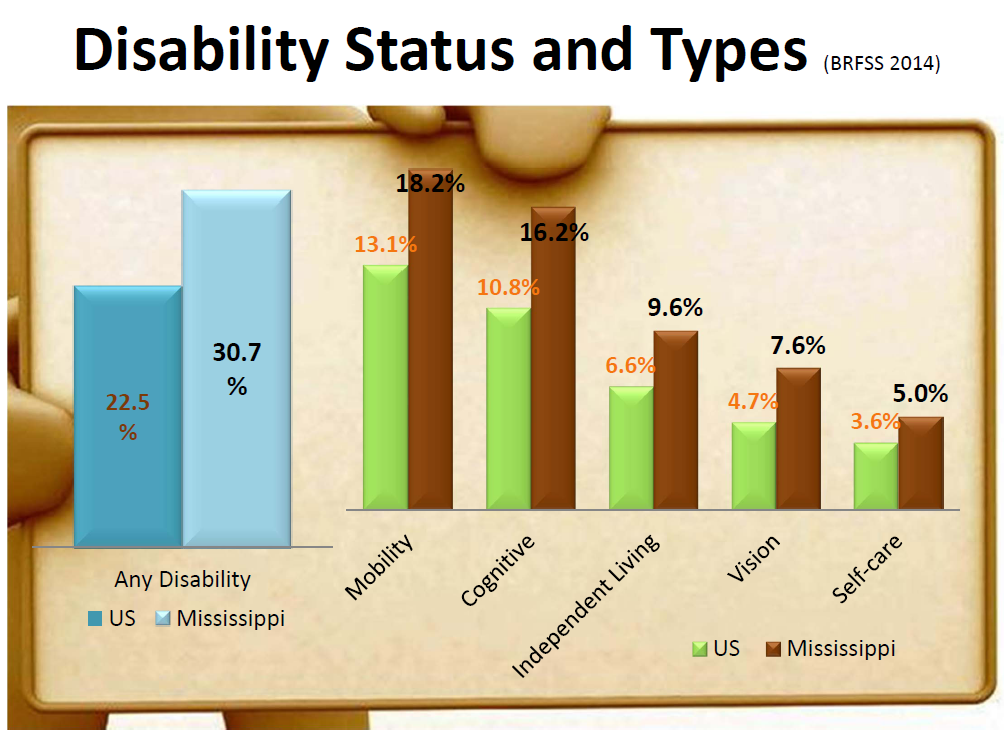

The chart below showing Mississippi's disability status supports the reason IDS staff advocates for and is committed to financial empowerment. The state's disability rates are higher than the United State's rates in all viewed categories.

Commitment to integrating financial empowerment

Over the years, IDS has used several resources/toolkits from curriculums such as FDIC Money Smart, Neighborworks America, Freddie Mac Credit Smart, Fannie Mae Guide to Homeownership, Mississippi Housing Initiatives, Mississippi State Extension Service Money Mentor Program, JumpStart, and Money Management International. HOYO program applicants must attend an eight-hour credit homebuyer education workshop to be considered for financial assistance in purchasing a home. Managing Your Money (Budgeting) and Understanding Credit are the key class components for empowering consumers with disabilities to reach their goals. PowerPoint slides, worksheets, case studies, role playing, games and other activities are used to engage the participants and make learning fun for every educational level. The information provided in the sessions offers a realistic picture to potential homeowners. Local lenders, federal and state programs and other community agencies assist IDS with workshops and other events.

The HOYO program has three full-time certified housing counselors and one part-time counselor. In 2016, IDS hosted 17 community workshops and provided education to 334 individuals, with many of those households having a family member with a disability. In addition, IDS partnered with many other local events to provide education to more community residents. Individualized one-on-one consumer financial counseling is provided to participants in IDS' housing programs that specifically target special needs households. Group education workshops are provided to consumers with and without disabilities to learning about growing wealth through homeownership.

IDS staff serve on various projects and councils throughout local communities to provide technical assistance as needed to further impact the lives of persons with disabilities. IDS' Director of Housing, Cassie Hicks, is a member of HUD's Housing Counseling Federal Advisory Committee (HCFAC) and the FDIC Gulf Coast/Delta AEI Affordable Housing Committee. In 2016, IDS co-hosted "The Affordable Housing Mortgage Bankers Forum" with FDIC Jackson Office-Dallas/Memphis Region. The goal of the forum was to discuss how utilizing grants (federal, state and foundation) can lower qualifying ratios for people with disabilities (which include a population of veterans) to purchase a home, along with increasing lenders' understanding of what is available and how to utilize the funds for this population.

As a result of the convening in D.C., it is anticipated that partners will gain an increased knowledge about the CFPB and FDIC, resources available and additional ways to engage in financial empowerment work with the CFPB and FDIC, plus new relationships with and information from other CFPB and FDIC partners.

The Institute for Disability Studies (IDS), Mississippi's University Center for Excellence (UCEDD), has been located for more than 40 years at The University of Southern Mississippi in Hattiesburg, with satellite offices in the state capitol of Jackson and on the Southern Miss Gulf Park campus in Long Beach. Serving people with developmental and other disabilities across the life span, IDS' work focuses on four vital emphasis areas-early childhood inclusion and education, wellness, housing, and transition to adulthood.